Turn “renting” into “roots.” Buy a home and unlock your dream lifestyle.

The Lifestyle Benefits of Owning a Home

Get It Right Now

Check Availability

Why Pay Rent when you can become a Homeowner?

Owning a home with affordable payments has a big impact, but it’s not just about having a house. It’s about creating a place to call home, bringing people together, and paving the way for a better life.

Many dream of owning a home, but the path can feel daunting. Yet, there’s more to it than just decorating. It’s about financial stability too. When housing costs eat up less than 30% of what you earn, owning becomes affordable. And it’s not just about the house; it’s about finding a place to belong, building connections in the community, and setting the stage for a better life.

Stressful Rent Paying

Stressfee Home-owning

From Renting

From Renting

Home Ownership

Renting

Upsides

- Equity Growth: Build wealth over time as your property value appreciates.

- Personalization Freedom: Customize your space to fit your lifestyle and preferences.

- Tax Advantages: Enjoy tax deductions on mortgage interest and property taxes.

- Payment Stability: Fixed mortgage payments provide financial predictability.

- Financial Independence: Invest in an asset that can provide long-term financial security.

- Residency Control: Have the freedom to stay as long as you want without lease constraints.

- Customization Options: Renovate and improve your home according to your vision.

- Pet Inclusion: Welcome pets without restrictions or additional fees.

- Investment Security: Real estate often proves to be a stable and reliable investment.

- Cost Management: Manage costs more effectively with predictable mortgage payments.

- Insurance Requirement: Protect your investment with homeowners insurance coverage.

Renting

Upsides

- Low Maintenance: Let the landlord handle maintenance and repairs.

- Value Preservation: Avoid the risks associated with fluctuating property values.

- Inclusive Amenities: Access shared amenities like gyms, pools, or community spaces.

- Convenient Bundles: Enjoy bundled services like utilities or internet for simplified living.

Downsides

- Tax Disadvantages: Miss out on tax deductions available to homeowners.

- Cost Increases: Rent may rise over time due to market conditions or landlord decisions.

- Landlord Support: Rely on landlord responsiveness for maintenance and support.

- Ownership Absence: Lack the potential wealth-building benefits of homeownership.

- Customization Limits: Limited ability to personalize or renovate the living space.

- Lease Commitment: Obligated to fulfill the lease term, limiting flexibility.

- Pet Restrictions: Face restrictions or additional fees for keeping pets in rented properties.

Have you ever considered the long-term benefits of homeownership?

In USA

If you’ve been renting for more than 5 years, you’ve basically thrown away over $100,000

While renting provides flexibility, buying a house allows you to build equity and potentially create wealth over time.

Think about it this way: if you’ve been renting for more than 5 years, you’ve basically thrown away over $100,000. Imagine if that money had been used to buy a place of your own!

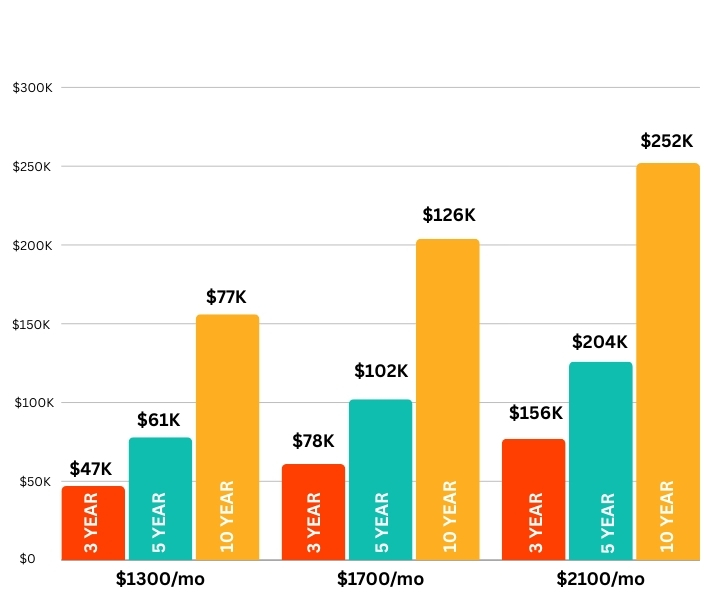

Let’s explore the financial side: Owning a home means your monthly payments contribute to your investment. For example, if you pay $1,300 in rent each month, that’s $15,600 a year. Over ten years, that’s a significant sum that could go towards a down payment and future ownership. While $1,700 a month? That’s over $204,000. And if it’s $2,100 a month, you’re looking at over $252,000—enough to buy a home outright.

So, why not invest in yourself? Owning a home means you’re not just throwing money away every month. Homeownership offers more than just financial advantages. It allows you to personalize your space, creating a home that reflects your style and needs. You can paint the walls, add bookshelves, or plant a garden – all things that contribute to a sense of belonging and stability.

Sure, owning has its costs—like taxes and repairs—but the benefits are huge. You’ll have something to call your own, and it’s a smart financial move in the long run.

If you’re tired of watching your money vanish, consider buying a home. With some help, you can find one that fits your budget and lifestyle. Stop wasting money on rent—start investing in yourself today.

Why We Are Here?

We understand that buying a home can feel overwhelming, but we’re here to simplify things for you. Here’s how we can help:

- Wondering how to get pre-qualified? We’ll guide you.

- Not sure what you can afford? Let’s figure it out together.

- Worried about the cost of a Buyer’s Agent? Don’t be-it’s free!

- Want to know how long it takes to close? We’ll break it down.

- Unsure about the home buying process? We’ll explain it step by step.

Testimonials

1. What's the big difference between owning and renting?

Owning means buying a house, while renting means paying to live in someone else’s house. When you own, you’re in charge of fixing things and paying taxes. When you rent, the landlord takes care of those things.

2. What's good about owning a home?

You build up ownership in your home over time. You can change things the way you like. Plus, if house prices go up, you could make money when you sell.

3. Do I get any tax breaks from owning?

Yes, sometimes. You might get to pay less tax on the interest you pay for your mortgage and your property taxes. But it depends on your situation and where you live.

4. Why should I buy instead of rent?

Disclaimer

Your content goes here. Edit or remove this text inline or in the module Content settings. You can also style every aspect of this content in the module Design settings and even apply custom CSS to this text in the module Advanced settings.